All Categories

Featured

[/image][=video]

[/video]

Withdrawals from the money worth of an IUL are generally tax-free approximately the amount of premiums paid. Any kind of withdrawals above this quantity may undergo tax obligations depending on plan framework. Standard 401(k) contributions are made with pre-tax dollars, minimizing taxable revenue in the year of the payment. Roth 401(k) payments (a plan function readily available in most 401(k) plans) are made with after-tax payments and after that can be accessed (profits and all) tax-free in retired life.

:max_bytes(150000):strip_icc()/dotdash-ask-answers-205-Final-7a1ca51b85d44e0d81dc7b46f919180d.jpg)

Withdrawals from a Roth 401(k) are tax-free if the account has been open for at the very least 5 years and the person is over 59. Assets taken out from a traditional or Roth 401(k) before age 59 might incur a 10% penalty. Not precisely The insurance claims that IULs can be your very own financial institution are an oversimplification and can be misleading for several reasons.

You might be subject to upgrading connected health inquiries that can influence your continuous expenses. With a 401(k), the cash is constantly yours, consisting of vested company matching regardless of whether you stop contributing. Risk and Guarantees: First and primary, IUL plans, and the cash value, are not FDIC guaranteed like typical savings account.

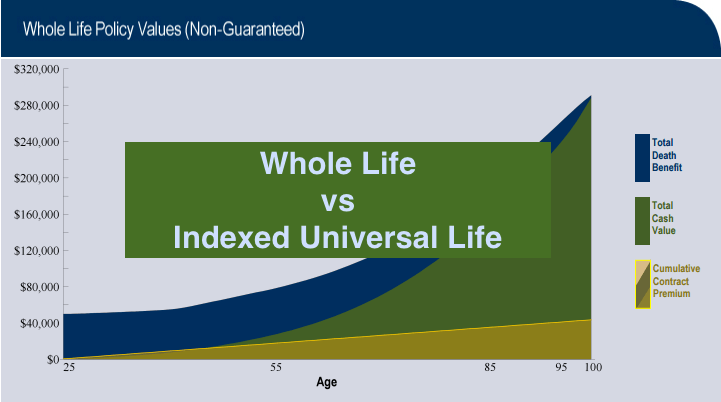

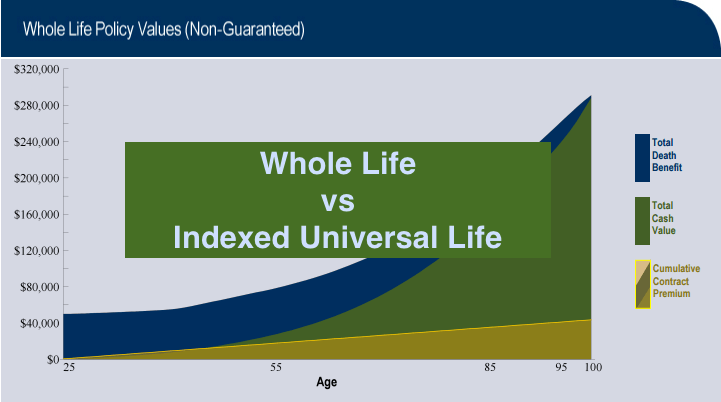

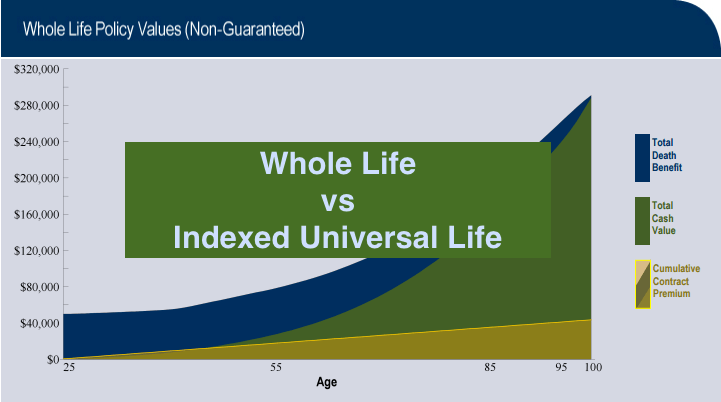

While there is typically a flooring to avoid losses, the development possibility is covered (meaning you may not fully gain from market upswings). A lot of experts will agree that these are not equivalent products. If you desire survivor benefit for your survivor and are concerned your retired life financial savings will not be sufficient, after that you might intend to take into consideration an IUL or various other life insurance policy item.

Certain, the IUL can supply accessibility to a money account, but once again this is not the primary function of the item. Whether you desire or need an IUL is a very specific question and relies on your key financial purpose and goals. Nevertheless, below we will certainly try to cover advantages and limitations for an IUL and a 401(k), so you can better mark these items and make a more informed choice pertaining to the very best way to handle retirement and dealing with your liked ones after death.

Nationwide Indexed Universal Life Insurance

Lending Prices: Car loans against the policy accumulate interest and, if not paid off, reduce the death advantage that is paid to the recipient. Market Participation Limits: For a lot of policies, financial investment growth is connected to a securities market index, yet gains are typically capped, limiting upside potential - index universal life insurance vs 401k. Sales Practices: These plans are frequently sold by insurance agents that might stress benefits without fully describing expenses and risks

While some social networks experts suggest an IUL is a substitute product for a 401(k), it is not. These are various items with different purposes, features, and costs. Indexed Universal Life (IUL) is a kind of long-term life insurance policy plan that also uses a money value part. The cash money worth can be utilized for numerous functions consisting of retirement cost savings, supplemental earnings, and other financial demands.

Latest Posts

Iul Italian University Line

Iul Università Costi

What Is Indexed Universal Life Insurance (Iul)?